UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | |

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| | | | | | | | |

| CHECK THE APPROPRIATE BOX: |

☑☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐☑ | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material Under Rule 14a-12 |

Oil States International, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| | | | | | | | | | | |

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

| ☑ | | No fee required. |

| ☐ | | Fee paid previously with preliminary materials:materials. |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | | | | | |

| Oil States International, Inc. intends to release definitive copies of the Proxy Statement to stockholders on or about March 28, 2023. | |

Three Allen Center, 333 Clay Street, Suite 4620

Houston, Texas 77002Notice of Annual Meeting of Stockholders

To Be Held on May 9, 2023

To the Stockholders of Oil States International, Inc.:

You are invited to our 20232024 Annual Meeting of Stockholders (the "Annual Meeting") of Oil States International, Inc., a Delaware corporation (the “Company”), which will be held virtually at www.meetnow.global/MCA4KMHvirtually. There will be no in-person meeting.

| | | | | |

| When: | 9:00 a.m. central daylight time Tuesday, May 7, 2024 |

| |

| Web Address: | www.meetnow.global/MQ6F5X6 |

The purpose of the Annual Meeting is to consider and act on Tuesday, the 9th day of May, 2023 at 9:00 a.m. central daylight time (the “Annual Meeting”), for the following purposes:following:

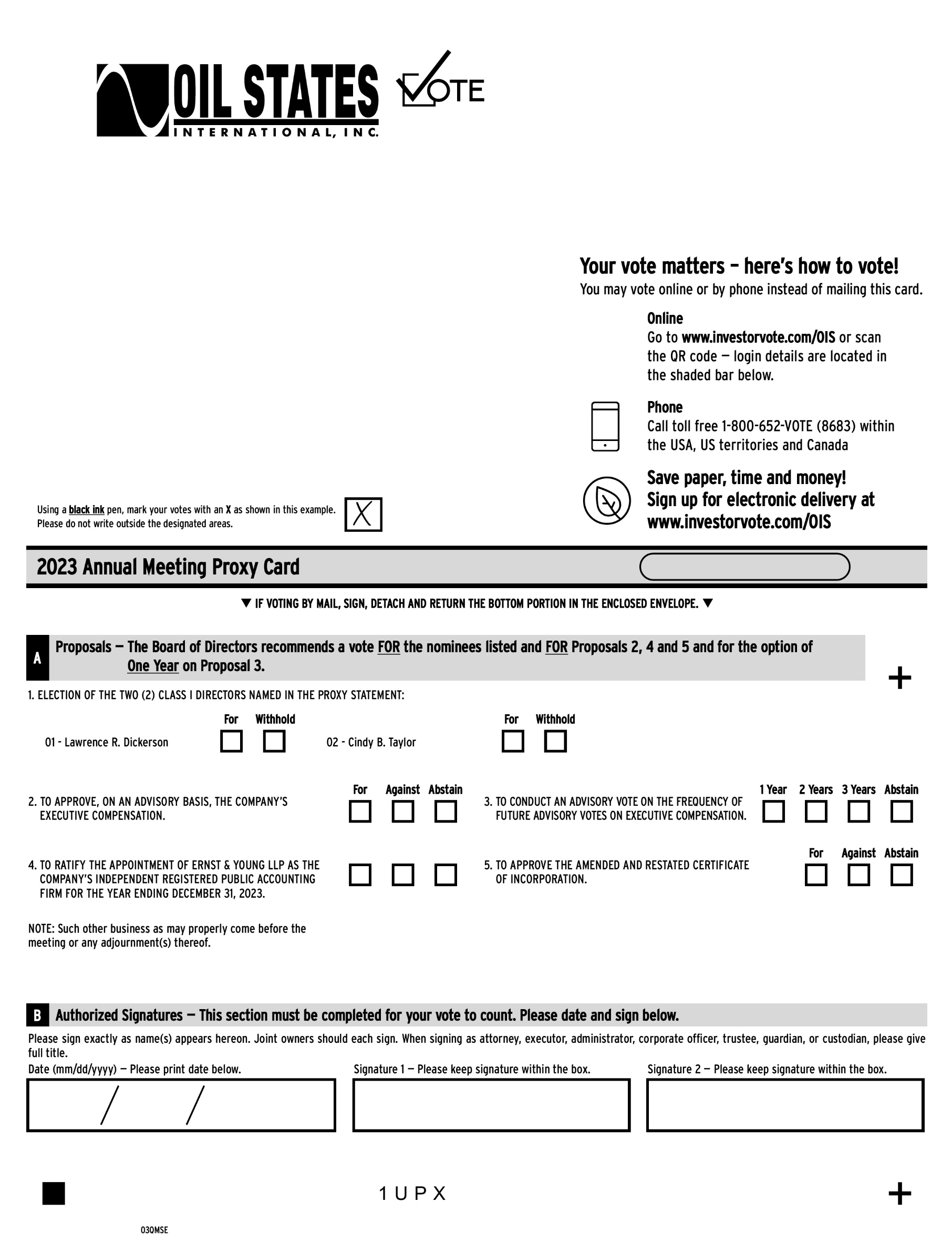

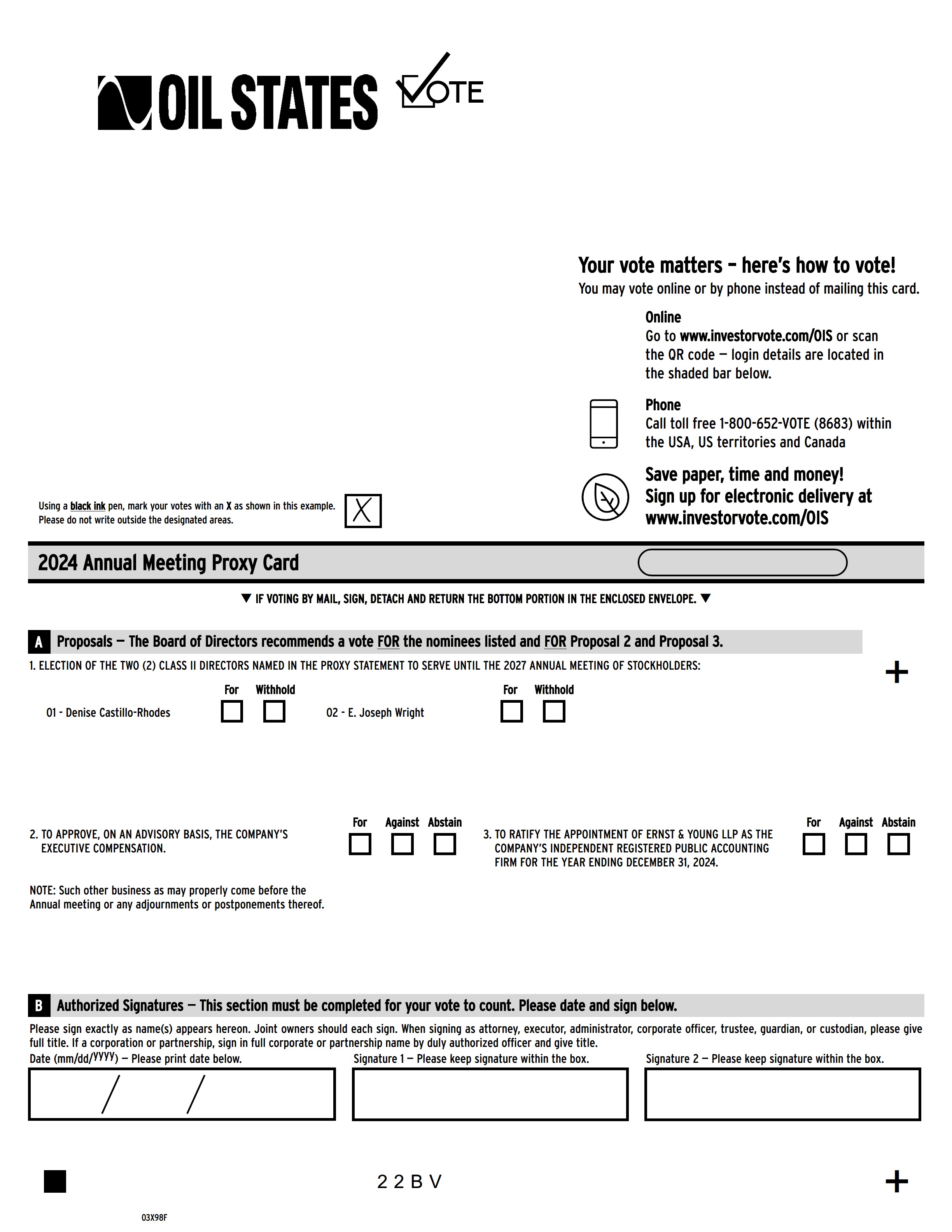

1.To elect the two (2) Class III members of the Board of Directors named in the Proxy Statement to serve until the 20262027 Annual Meeting of Stockholders (Item 1 - see page 1211); 2.To conduct an advisory vote to approve executive compensation (Item 2 - see page 3132); 3.To conduct an advisory vote regarding frequency of future advisory votes on executive compensation (Item 3 - see page 32); 4.To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 20232024 (Item 4 - see page 65);5.To approve the Amended and Restated Certificate of Incorporation (Item 53 - see page 67);6.4.To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

The Board of Directors unanimously recommends that you vote FOR Items 1, 2 4 and 5 and for the option of ONE YEAR on Item 3.

The Company has fixed the close of business on March 15, 202313, 2024 as the "Record Date" for determining stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof.

By Order of the Board of Directors

Sincerely,

William E. Maxwell

Corporate Secretary

Houston, Texas

March 26, 2024

YOUR VOTE IS IMPORTANT

It is important that your shares be represented and voted at the meeting.Annual Meeting. Please complete, sign and return a proxy card, or use the telephone or internet voting systems.

A copy ofATTENDING THE MEETING

To participate in the Company’s 2022 Annual ReportMeeting, you will need to review the information included on Form 10-K accompanies this Notice and Proxy Statement and is availableyour notice, on your proxy card or on the websiteinstructions that accompanied your proxy materials.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance using the instructions listed below.

By Order of the Board of Directors

Sincerely,

William E. Maxwell

Corporate Secretary

Houston, Texas

March 28, 2023on page 6.IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 9, 2023: A COPY OF THIS PROXY STATEMENT, PROXY VOTING CARD AND THE COMPANY’S ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2022 | | | | | | | | |

| | |

| IMPORTANT INFORMATION REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 7, 2024: A COPY OF THIS PROXY STATEMENT, PROXY VOTING CARD AND THE COMPANY’S ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2023 ARE AVAILABLE AT WWW.IR.OILSTATESINTL.COM/PROXY-MATERIALSWWW.IR.OILSTATESINTL.COM/PROXY-MATERIALS. | |

| | |

WE WILL CONDUCT THE ANNUAL MEETING SOLELY ONLINE VIA THE INTERNET THROUGH A LIVE WEBCAST AND ONLINE STOCKHOLDER TOOLS. WE BELIEVE A VIRTUAL FORMAT FACILITATES STOCKHOLDER ATTENDANCE AND PARTICIPATION BY LEVERAGING TECHNOLOGY TO ALLOW US TO COMMUNICATE MORE EFFECTIVELY AND EFFICIENTLY WITH OUR STOCKHOLDERS. THIS FORMAT EMPOWERS STOCKHOLDERS AROUND THE WORLD TO PARTICIPATE AT NO COST. WE HAVE DESIGNED THE VIRTUAL FORMAT TO ENHANCE STOCKHOLDER ACCESS AND PARTICIPATION AND PROTECT STOCKHOLDER RIGHTS.

THE PROXY STATEMENT PROVIDES INFORMATION ON HOW TO JOIN THE ANNUAL MEETING ONLINE AND ABOUT THE BUSINESS WE PLAN TO CONDUCT.

Table of Contents | | | | | |

| Page |

| |

| |

| |

| |

| |

| |

Item 3 – Advisory Vote Regarding Frequency of Future Advisory Votes on Executive Compensation | |

| |

| Item 5 – Approval of the Amended and Restated Certificate of Incorporation |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | |

| 4 | 20232024 Proxy Statement |

Proxy Summary

This summary provides only a brief outline of selected information contained elsewhere in this Proxy Statement and does not provide a full and complete discussion of the information you should consider. Before voting on the items to be presented at the 20232024 Annual Meeting of Stockholders (the “Annual Meeting”), you should review the entire Proxy Statement carefully. References to “Oil States,” “we,” “us,” “our” and the “Company” mean Oil States International, Inc. and its consolidated subsidiaries, unless the context otherwise indicates or requires. For more complete information regarding our 20222023 performance, please review the Company’s 20222023 Annual Report on Form 10-K (the “Form 10-K”).

The Company’s Form 10-K is being provided to stockholders together with this Proxy Statement and form of proxy beginning on or about March 28, 2023.26, 2024. Our principal offices are located at Three Allen Center, 333 Clay Street, Suite 4620, Houston, Texas 77002.

20232024 Annual Meeting of Stockholders

| | | | | | | | |

| | |

| | |

| | |

TIME AND DATE Tuesday, May 9, 2023,7, 2024, 9:00 a.m. (central daylight time) | LOCATION Virtual Stockholder Meeting www.meetnow.global/MCA4KMHMQ6F5X6 | RECORD DATE March 15, 202313, 2024 |

| | |

Agenda and Voting Recommendations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

ITEM 1 Election of Directors | | ITEM 2 Advisory Vote on Executive Compensation | | ITEM 3 Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation

| | ITEM 4

Ratification of Appointment of Independent Registered Public Accounting Firm | | ITEM 5

Approval of Amended and Restated Certificate of Incorporation

|

| | | | | | | | |

| FOR each of the nominees | | | FOR | | | FOR the option of ONE YEAR

| | | FOR

| | | FOR |

| | | | | | | | | | | | | |

Voting Methods

If you are a stockholder of record, you may vote using one of the following options. In all cases, please have your proxy card in hand and follow the instructions.

| | | | | | | | | | | |

| | | |

| | | |

| | | |

IN PERSON ONLINE Attend the virtual annual meeting at www.meetnow.global/MCA4KMHMQ6F5X6 | BY MAIL Follow the instructions to mark, sign and date your proxy card | BY PHONE Use any touch-tone telephone to transmit your voting instructions 1-800-652-VOTE(8683) | BY INTERNET Use the internet to transmit your voting instructions www.investorvote.com/OIS |

Online Meeting

We will conduct the Annual Meeting solely online via the internet through a live webcast and online stockholder tools. We believe a virtual format facilitates stockholder attendance and participation by leveraging technology to allow us to communicate more effectively and efficiently with our stockholders. This format empowers stockholders around the world to participate at no cost. We have designed the virtual format to enhance stockholder access and participation and protect stockholder rights.

We Encourage Questions. Stockholders may submit a question live during the meeting, following the instructions below. During the meeting, we will answer as many appropriate stockholder-submitted questions as time permits.

We Proactively Take Steps to Facilitate Your Participation. During the Annual Meeting, we will offer live technical support for all stockholders attending the meeting.

Meeting Admission

The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively by webcast. You are entitled to participate in the Annual Meeting only if you were a stockholder of the Company as of the close of business on the Record Date, or if you hold a valid proxy for the Annual Meeting. No physical meeting will be held.

You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.meetnow.global/MCA4KMHMQ6F5X6. You also will be able to vote your shares online by attending the Annual Meeting by webcast.

To participate in the Annual Meeting, you will need to review the information included on your notice, on your proxy card or on the instructions that accompanied your proxy materials.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance using the instructions below.

The online meeting will begin promptly at 9:00 a.m., central daylight time. We encourage you to access the meeting prior to the start time leaving ample time for the check in. Please follow the registration instructions as outlined in this proxy statement.

If you are a registered stockholder (i.e., you hold your shares through our transfer agent, Computershare), you do not need to register to attend the Annual Meeting virtually on the internet. Please follow the instructions on the notice or proxy card that you received.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the Annual Meeting virtually on the internet.

To register to attend the Annual Meeting online by webcast you must submit proof of your proxy power (legal proxy) reflecting your Oil States International, Inc. holdings along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 4:00 p.m., central daylight time, on Thursday, May 4, 2023.2, 2024.

You will receive a confirmation of your registration by email after we receive your registration materials.

Requests for registration should be directed to us at the following:

•By email

Forward the email from your broker, or attach an image of your legal proxy, to legalproxy@computershare.com

•By mail

Computershare

Oil States International, Inc. Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

The virtual meeting platform is fully supported across browsers (MS Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Please note that Internet Explorer is not a supported browser. Participants should ensure that they have a strong Wi-Fi connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time. A link on the meeting page will provide further assistance should you need it or you may call (888) 724-2416 or (781) 575-2748 for international.

We are excited to embrace technology to provide expanded access, improved communication and cost savings for our stockholders and the Company. We believe that hosting a virtual meeting will enable more of our stockholders to attend and participate in the meeting since our stockholders can participate from any location around the world with internet access.

In accordance with the Delaware General Corporation Law, a list of the Company’s stockholders of record will be available and may be inspected for a period of at least ten days prior to the Annual Meeting. Stockholders as of the record date may inspect the stockholder list by calling the Company’s Corporate Secretary at (713) 470-4863 to schedule an appointment. Stockholders who have a control number will also be able to review the list of stockholders of record during the Annual Meeting through the meeting website.

| | | | | |

| 6 | 20232024 Proxy Statement |

| | | | | | | | | | | |

| | | |

ITEM 1 | | | |

| To elect the two (2) Class III members of the Board of Directors named in this Proxy Statement to serve until the 20262027 Annual Meeting of Stockholders. The term of the threetwo current Class III directors will expire at the Annual Meeting. Christopher T. Seaver, a current Class I director, is not standing for re-election and will retire when his term expires at the Annual Meeting. As further described beginning on page 1211 of this Proxy Statement, the Board of Directors is currently comprised of eightseven members. The eightseven members are divided into three classes currently having threetwo members in each of Class I and III,II, and twothree members in Class II.III. Each class is elected for a term of three years so that the term of one class of directors expires at each Annual Meeting of Stockholders. | |

|

| | | |

| | | |

| | | |

| | The Board of Directors recommends that stockholders vote “FOR” the election of each of the Class III director nominees named below. | |

| | |

The Oil States Board of Directors

Set forth below are the names of, and certain information with respect to, the Company’s directors, including the two (2) nominees for election to the Class III positions on the Board of Directors as of March 28, 2023.26, 2024.

| | | | | | | COMMITTEES | | | | | | | | COMMITTEES |

| | NAME AND PRINCIPAL OCCUPATION | |

| NAME AND PRINCIPAL OCCUPATION | |

| NAME AND PRINCIPAL OCCUPATION | | AGE | DIRECTOR

SINCE | INDEPENDENT | | OTHER CURRENT PUBLIC

COMPANY BOARDS | A | C | NG&S |

| | | COMMITTEES |

| NAME AND PRINCIPAL OCCUPATION | AGE | DIRECTOR

SINCE | INDEPENDENT | OTHER CURRENT PUBLIC

COMPANY BOARDS | A | C | NG&S |

CLASS I DIRECTORS

(NOMINEES TO SERVE UNTIL 2026) | |

CLASS II DIRECTORS

(NOMINEES TO SERVE UNTIL 2027) | |

| CLASS II DIRECTORS

(NOMINEES TO SERVE UNTIL 2027) | |

| CLASS II DIRECTORS

(NOMINEES TO SERVE UNTIL 2027) | |

| Denise Castillo-Rhodes

Chief Financial Officer, Texas Medical Center | |

| Denise Castillo-Rhodes

Chief Financial Officer, Texas Medical Center | |

| Denise Castillo-Rhodes

Chief Financial Officer, Texas Medical Center | |

| E. Joseph Wright

Former Director, Executive Vice President and Chief Operating Officer, Concho Resources, Inc. | |

| E. Joseph Wright

Former Director, Executive Vice President and Chief Operating Officer, Concho Resources, Inc. | |

| E. Joseph Wright

Former Director, Executive Vice President and Chief Operating Officer, Concho Resources, Inc. | | 64 | 2018 | | | •CES Energy Solutions Corp. | | | |

| CLASS III DIRECTORS

(TERM EXPIRING IN 2025) | |

| CLASS III DIRECTORS

(TERM EXPIRING IN 2025) | |

| CLASS III DIRECTORS

(TERM EXPIRING IN 2025) | |

| Darrell E. Hollek

Former Executive

Vice President, Operations,

Anadarko Petroleum Corporation | |

| Darrell E. Hollek

Former Executive

Vice President, Operations,

Anadarko Petroleum Corporation | |

| Darrell E. Hollek

Former Executive

Vice President, Operations,

Anadarko Petroleum Corporation | | 67 | 2018 | | | •None | | | |

| Robert L. Potter

Chair, Oil States International, Inc.

Former President,

FMC Technologies, Inc. | |

| Robert L. Potter

Chair, Oil States International, Inc.

Former President,

FMC Technologies, Inc. | |

| Robert L. Potter

Chair, Oil States International, Inc.

Former President,

FMC Technologies, Inc. | | 73 | 2017 | | | •None | | | |

| Hallie A. Vanderhider

Former Managing Director,

SFC Energy Partners | |

| Hallie A. Vanderhider

Former Managing Director,

SFC Energy Partners | |

| Hallie A. Vanderhider

Former Managing Director,

SFC Energy Partners | |

| CLASS I DIRECTORS

(TERM EXPIRING IN 2026) | |

| CLASS I DIRECTORS

(TERM EXPIRING IN 2026) | |

| CLASS I DIRECTORS

(TERM EXPIRING IN 2026) | |

| Lawrence R. Dickerson

Former Director, President

and Chief Executive Officer,

Diamond Offshore Drilling, Inc. | Lawrence R. Dickerson

Former Director, President

and Chief Executive Officer,

Diamond Offshore Drilling, Inc. | 70 | 2014 | | •Chairman, Great Lakes Dredge & Dock Corporation •Murphy Oil Corporation | | | |

| Lawrence R. Dickerson

Former Director, President

and Chief Executive Officer,

Diamond Offshore Drilling, Inc. | |

| Lawrence R. Dickerson

Former Director, President

and Chief Executive Officer,

Diamond Offshore Drilling, Inc. | |

| Cindy B. Taylor

President and

Chief Executive Officer,

Oil States International, Inc. | Cindy B. Taylor

President and

Chief Executive Officer,

Oil States International, Inc. | 61 | 2007 | | •AT&T Inc. | |

CLASS I DIRECTOR

(RETIRING AT END OF TERM EXPIRING IN 2023) | |

Christopher T. Seaver

Former Chairman and

Chief Executive Officer,

Hydril Company | 74 | 2008 | | •None | | |

CLASS II DIRECTORS

(TERM EXPIRING IN 2024) | |

Denise Castillo-Rhodes

Chief Financial Officer, Texas Medical Center | 62 | 2021 | | •None | | |

E. Joseph Wright

Former Director, Executive Vice President and Chief Operating Officer, Concho Resources, Inc. | 63 | 2018 | | •CES Energy Solutions Corp. | | |

CLASS III DIRECTORS

(TERM EXPIRING IN 2025) | |

Darrell E. Hollek

Former Executive

Vice President, Operations,

Anadarko Petroleum Corporation | 66 | 2018 | | •None | | | |

Robert L. Potter

Chairman,

Oil States International, Inc.

Former President,

FMC Technologies, Inc. | 72 | 2017 | | •None | | |

Hallie A. Vanderhider

Former Managing Director,

SFC Energy Partners | 65 | 2019 | | •EQT Corporation | | |

| Cindy B. Taylor

President and

Chief Executive Officer,

Oil States International, Inc. | |

| Cindy B. Taylor

President and

Chief Executive Officer,

Oil States International, Inc. | |

|

| | | | | | | | | | | | | | | | | |

| A | Audit Committee | C | Compensation Committee | NG&S | Nominating, Governance and Sustainability Committee |

| Chair | | Member | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

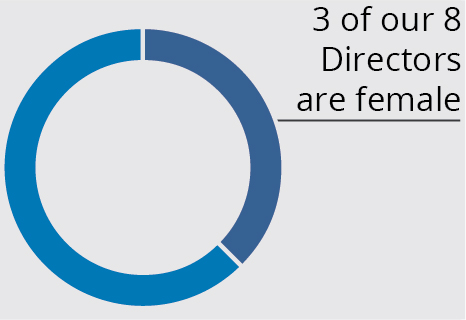

| Director Independence | | | Gender Diversity | | Director Skills and Experience | | |

| | | | | | | | | | | |

| | | | 1 of our 87 Directors is Hispanic | | | Executive Leadership | | 87 | |

| | | | | Financial Experience | | 87 | |

| | | | | Energy/Oilfield

Services | | 76 | |

| Director Tenure | | | | | Outside Board

Experience | | 76 | |

| | Director Tenure | | | | International

Operations | | 54 | |

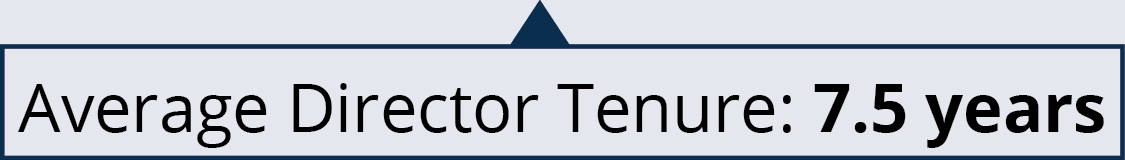

| | | | | | | | | |

| 0-40-5 years

| 5-116-11 years

| 12+ years | |

| |

| | | Past or Present CFO | | 4 | |

|

| | | Past or Present CEO | | 32 | |

| | | Our Directors bring leadership skills and experience in areas relevant to Oil States | | |

| | | | | | | | | | | | | | |

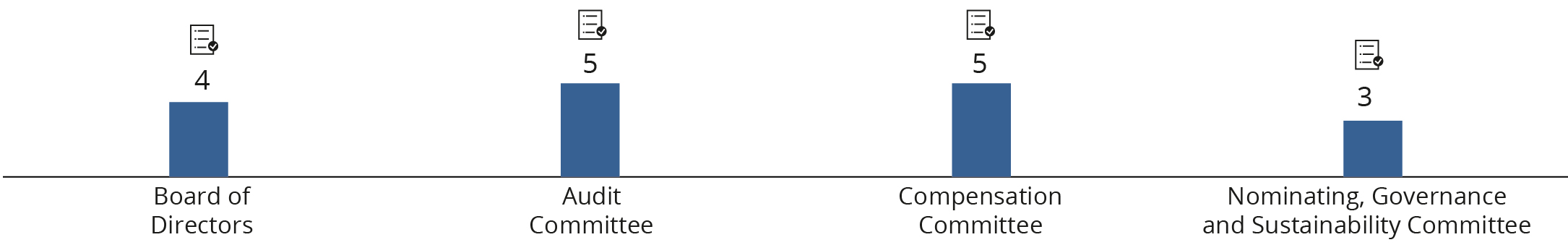

Corporate Governance

Oil States has corporate governance policies and guidelines that the Board of Directors believes are consistent with Oil States’ values, and that promote the effective functioning of the Board, its committees and the Company. The Corporate Governance section of this Proxy Statement beginning on page 20 describes our governance framework, which includes the following: Board and Governance Information

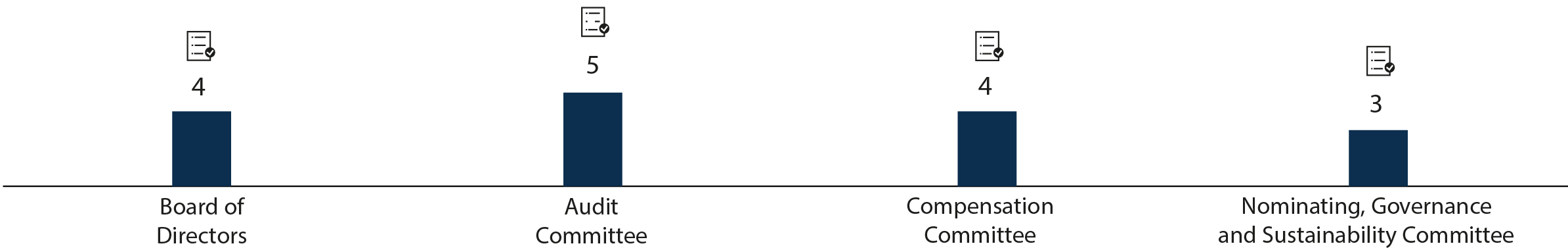

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Size of

Board | | | Separate Chairman

Independent Chair and CEO Roles | | | Board Risk Assessment

Oversight | | | Stock Ownership

Guidelines for Directors

and Executive Officers |

87 | | | Yes | | | Yes | | | Yes |

| | | | | | | | | |

| | | | | | | | | |

Number of

Independent Directors | | | Independent Directors

Meet in Executive

Session | | | Code of Conduct for

Directors, Officers

and Employees | | | Anti-Hedging and

Pledging Policies |

76 | | | Yes | | | Yes | | | Yes |

| | | | | | | | | |

| Board Meetings Held

in 2022 | | | | | | | | |

| Stockholder Engagement | | | Annual Board and

Committee Evaluations | | | Incentive Compensation Recoupment and

Clawback PolicyPolicies | | | Financial Code of Ethics

for Senior Officers |

4Yes | | | Yes | | | Yes | | | Yes |

| | | | | | | | | | | |

ITEM 2 | | | |

| To conduct an advisory vote to approve executive compensation. The Board of Directors believes Oil States’ executive compensation program closely links executive compensation to the execution of our strategy and accomplishment of our goals that coincide with stockholder objectives. We recommend that you review our Compensation Discussion and Analysis beginning on page 3132, which explains in greater detail our executive compensation programs. While the outcome of this proposal is non-binding, the Board of Directors and Compensation Committee will consider the outcome of the vote when making future compensation decisions. | |

|

|

| | | |

| | | |

| | The Board of Directors recommends a vote “FOR” the adoption, on an advisory basis, of the resolution approving the compensation of our Named Executive Officers. | |

| | |

Our Compensation Philosophy

The Company’s philosophy regarding the executive compensation program for our Named Executive Officers (together referred to as the “NEOs”) and other senior managers has been to design a compensation package that provides competitive base salary levels and compensation incentives that (i) attract and retain individuals of outstanding ability in these key positions, (ii) recognize corporate performance relative to established goals and the performance of the Company relative to the performance of other companies of comparable size, complexity and quality and against budget goals, and (iii) support both the short-term and long-term strategic goals of the Company. The Company’s compensation programs are designed to provide compensation that:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Attracts, motivates, rewards and retains high-performinghigh-performing executives | | Reinforces the relationship between strong individual performance of executives and business results | | Aligns the interests of our executives with the long-term interests of our stockholders | | Neither promotes overly conservative actions or excessive risk taking |

| | | | | | |

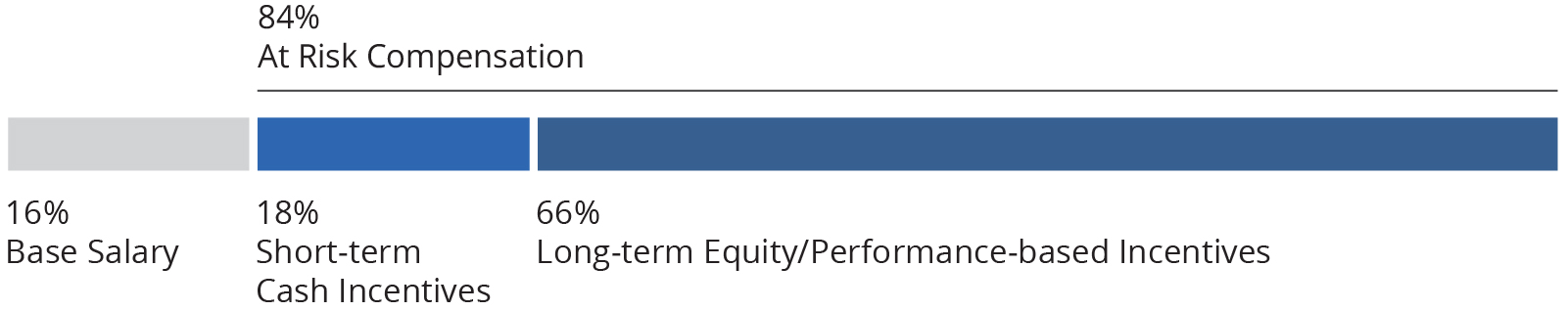

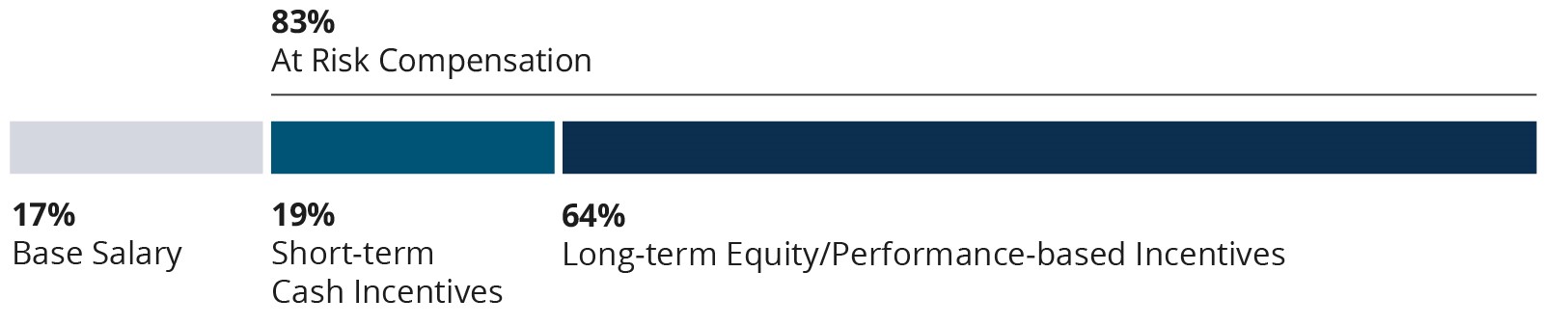

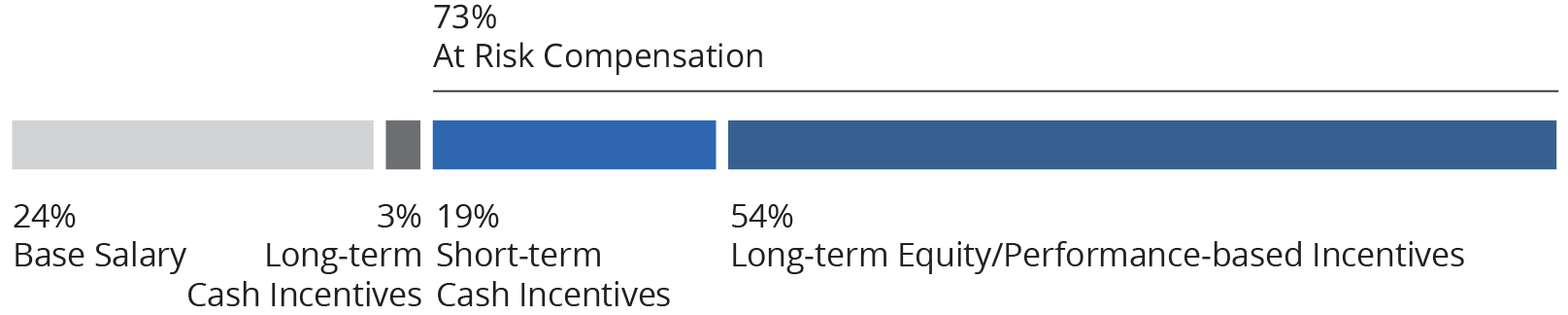

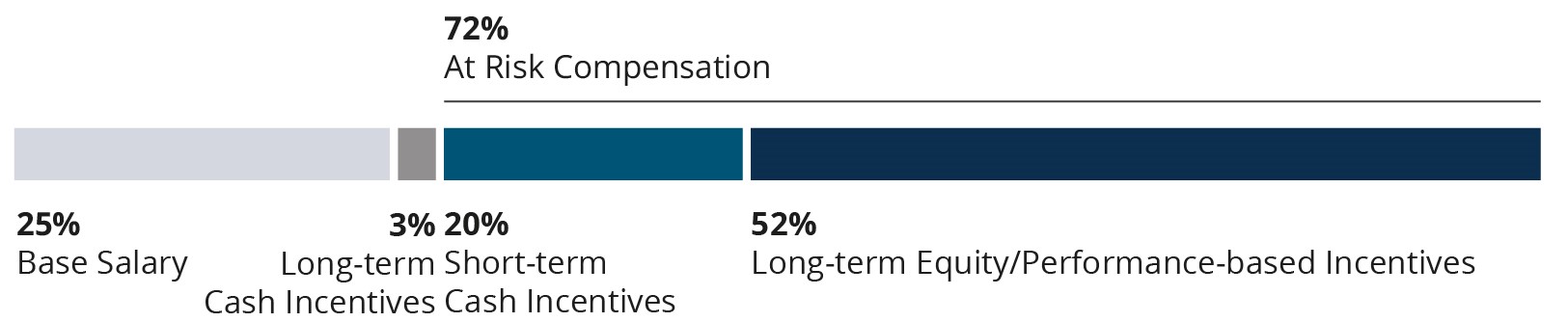

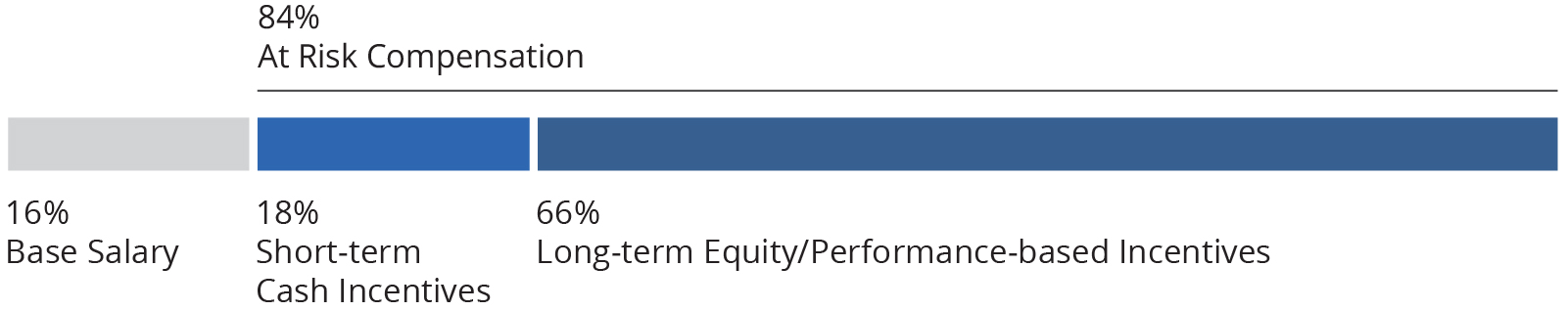

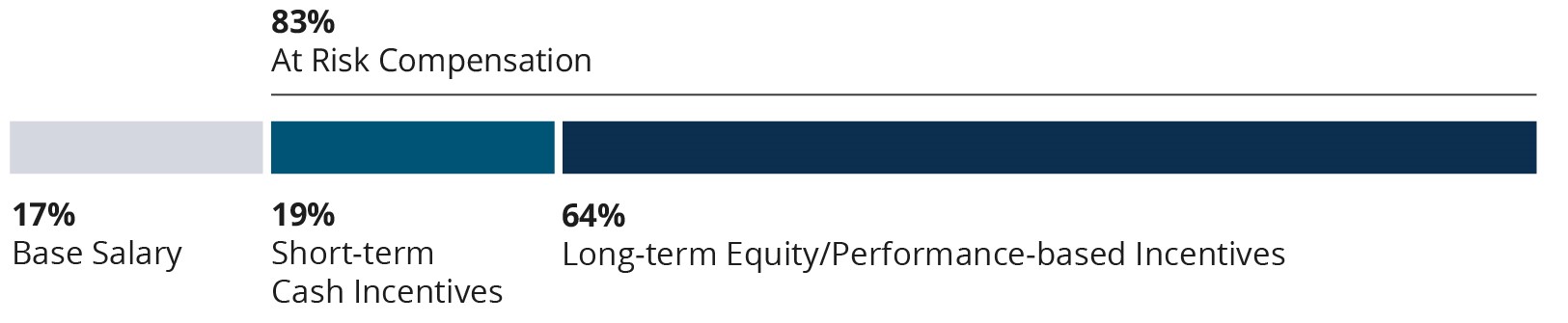

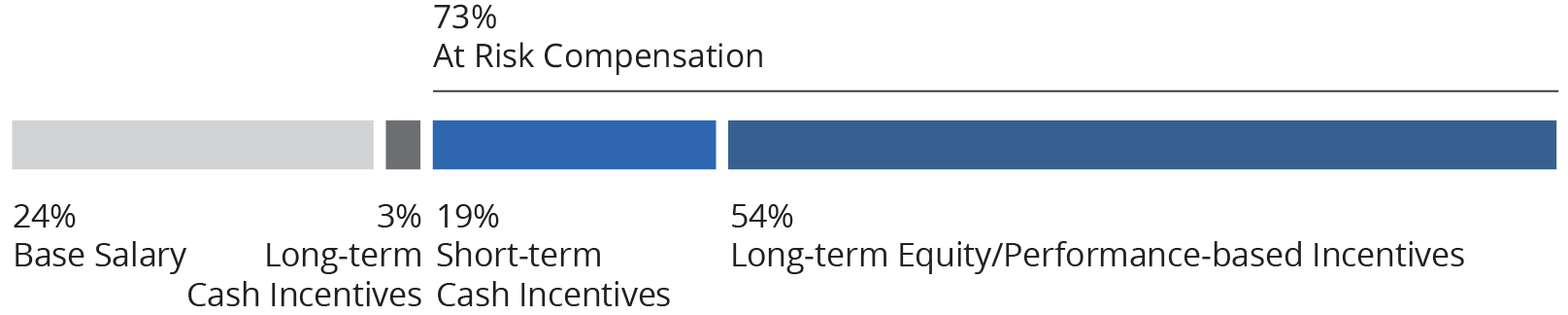

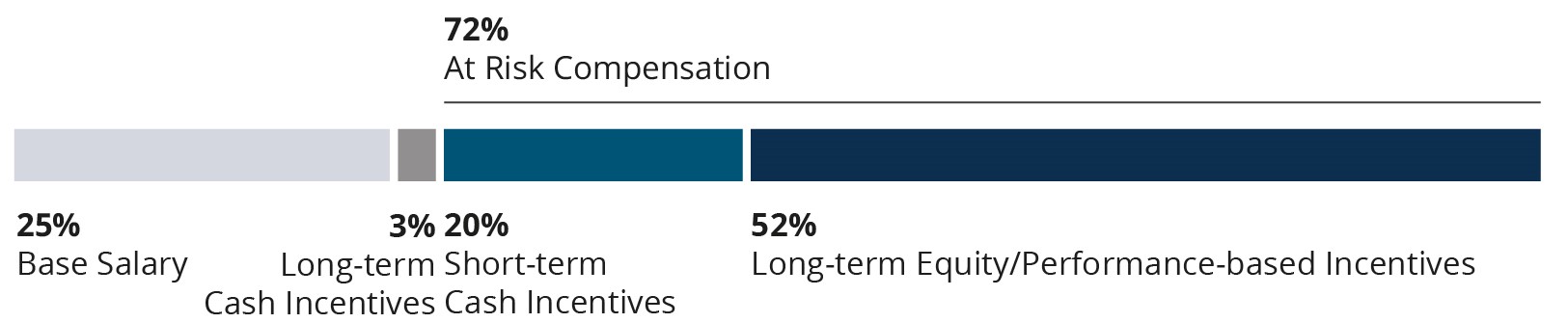

In order to further its pay-for-performance goal, the Compensation Committee has determined it appropriate to deliver a significant portion of executive compensation as at risk compensation, including both short- and long-term incentives. The following charts depict elements of the target compensation for the CEOChief Executive Officer and collectively for the other NEOsNamed Executive Officers of the Company.

20222023 Target Compensation Mix

| | | | | |

CEOCHIEF EXECUTIVE OFFICER | |

| |

ALL OTHER NAMED

EXECUTIVE OFFICERS | |

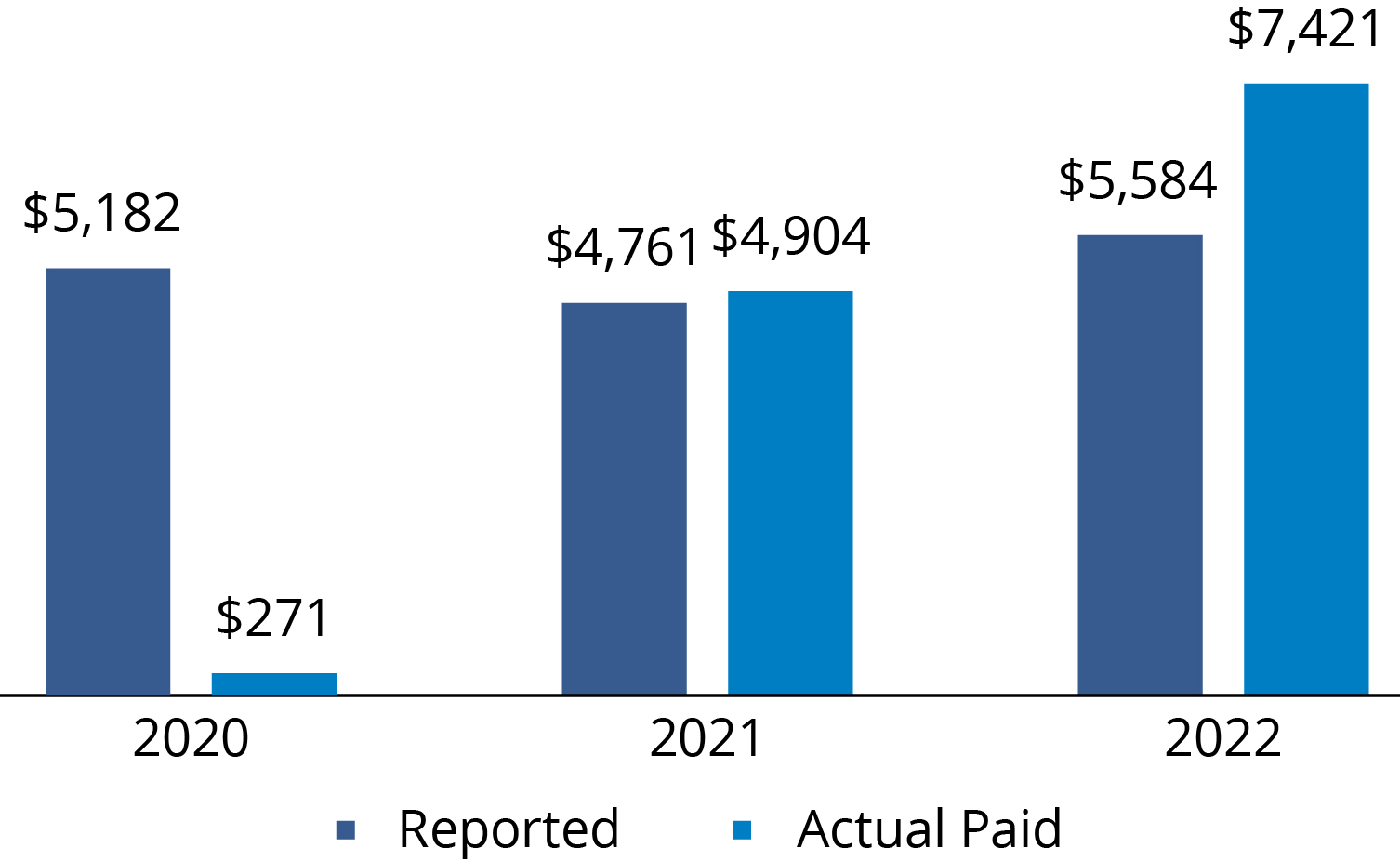

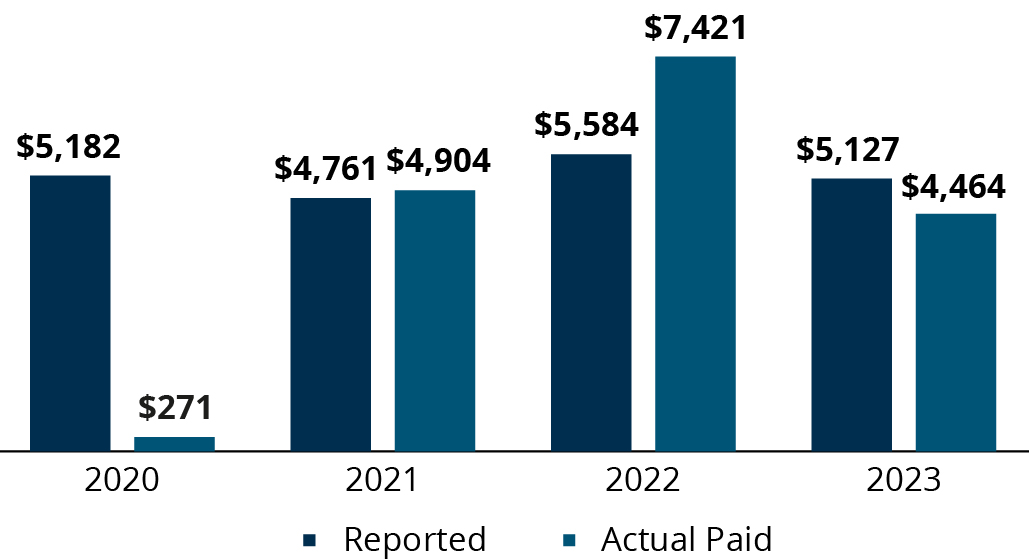

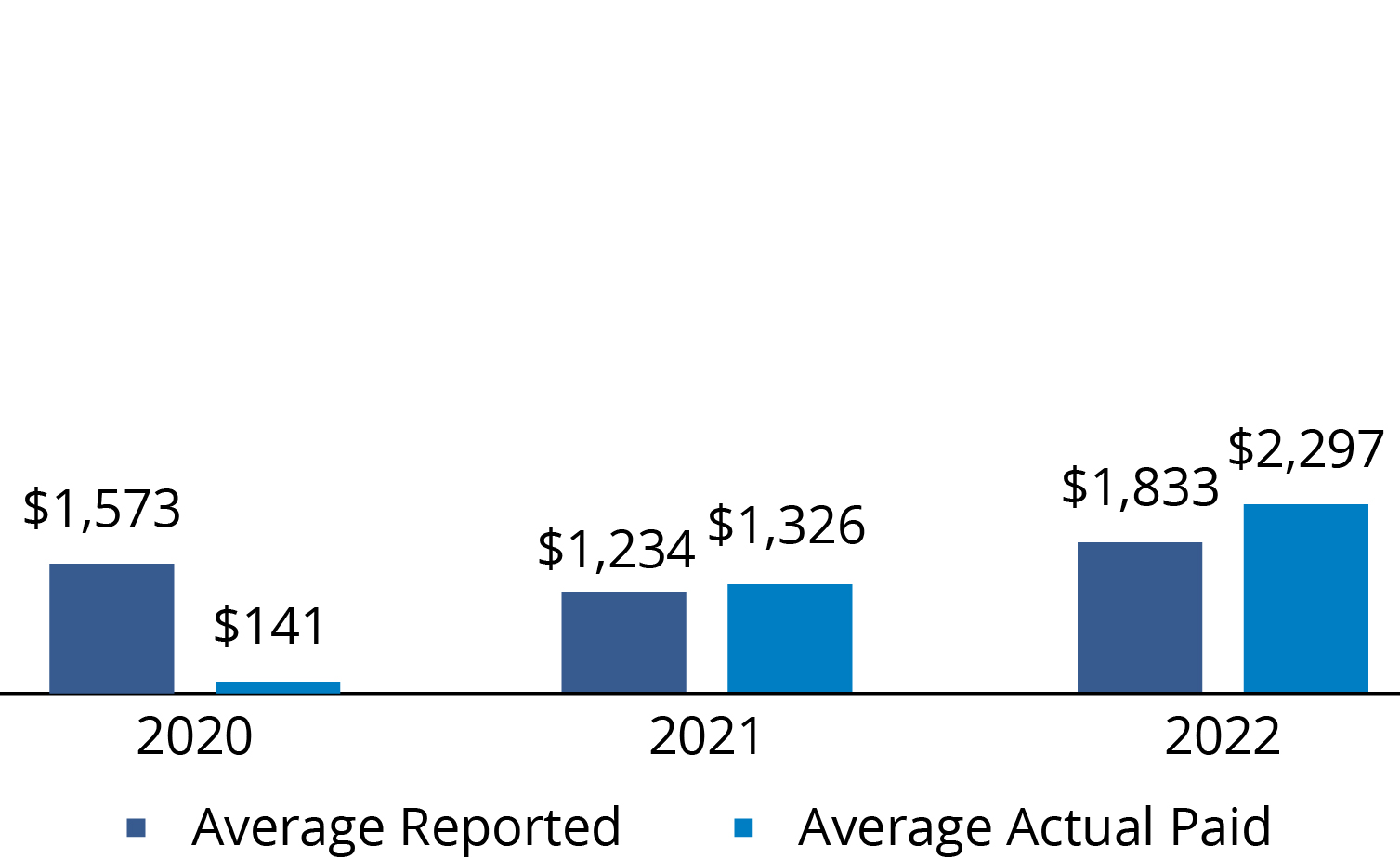

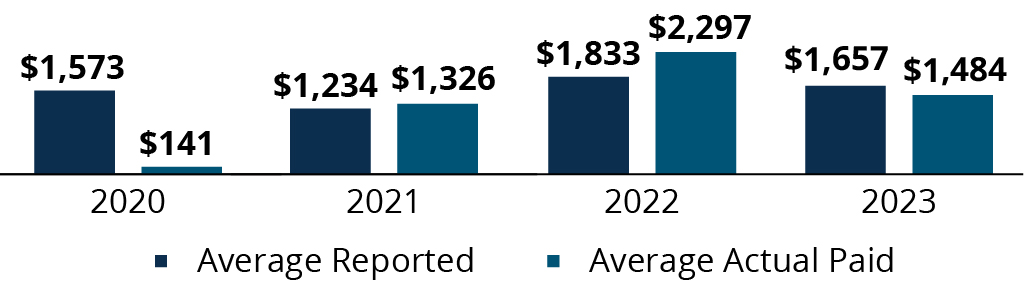

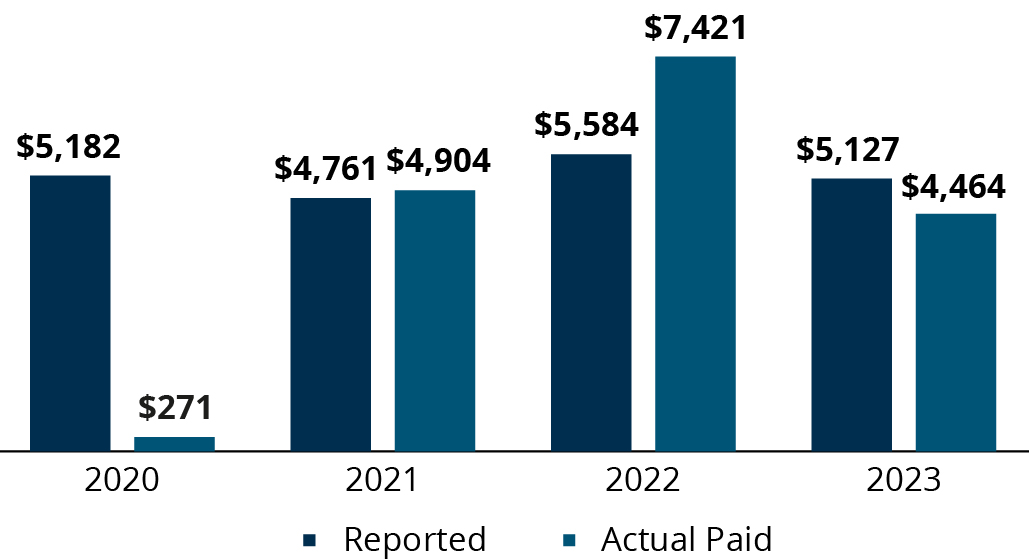

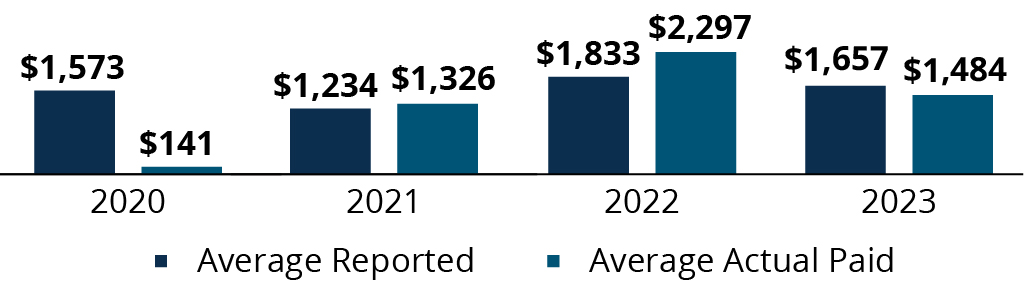

Reported versus Actual Paid Values of Executive Compensation

The Compensation Committee is committed to targeting reasonable and competitive compensation for the NEOs.Named Executive Officers. Because a significant portion of the NEOs’Named Executive Officers’ compensation is at risk (73%(72% to 84%83% for 20222023 as shown above), the target values established at the date of award may vary substantially from the actualvalues actually paid values from year-to-year, particularly given the highly cyclical nature of the energy services industry.

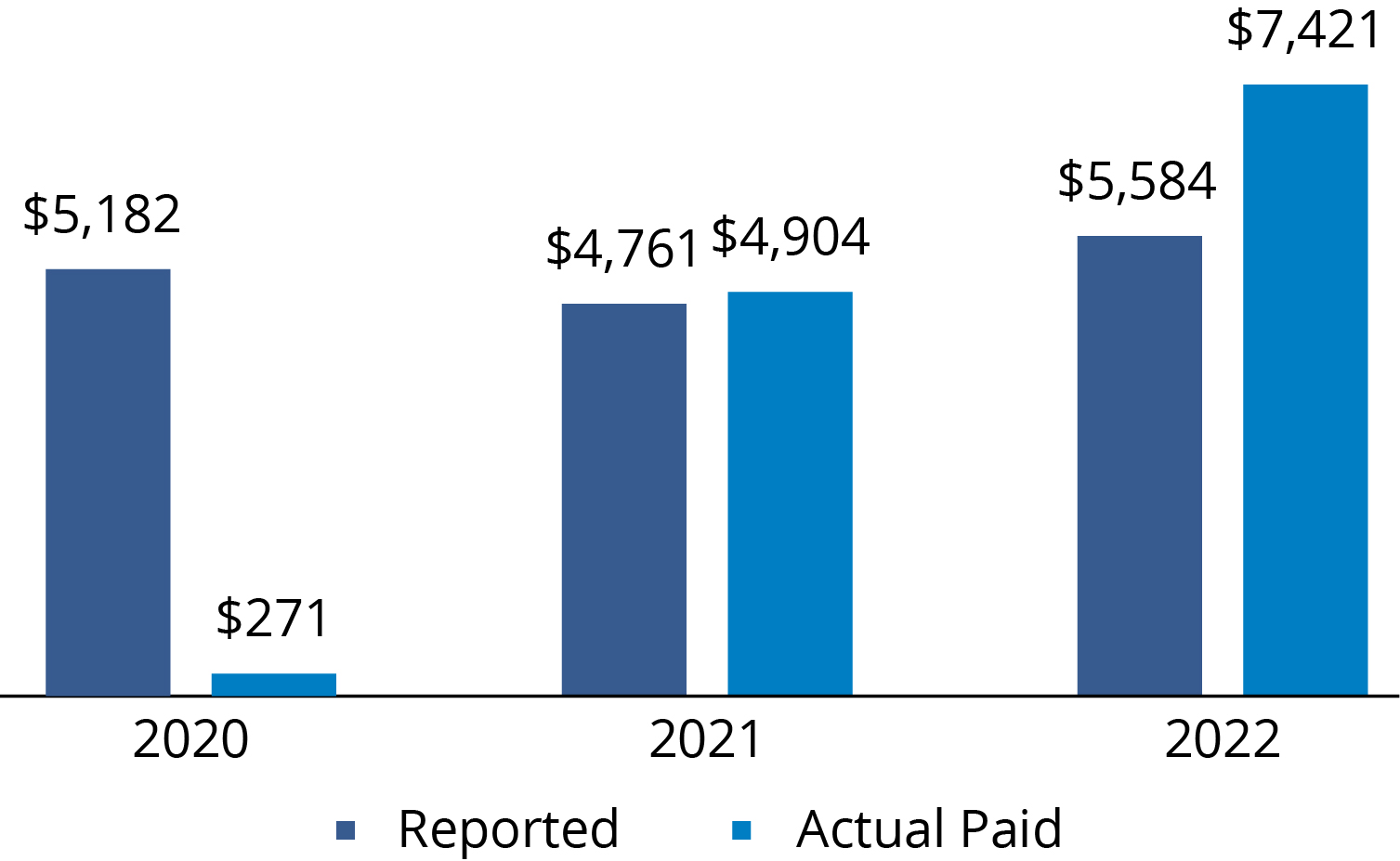

“Reported compensation” is the total compensation that is reported in the Summary Compensation Table of our Proxy Statement which reflects equity awards at grant date values. As further described and detailed under "Pay versus Performance" beginning on page 6162, “actual compensation paid” values presented in the tables below for 2020, 2021 and 2022 were determined in accordance with recently issued rules underthe requirements of Item 402(v) of Regulation S-K, which requiredrequires the Company to make certain adjustments to equity compensation amounts reported in the Summary Compensation Table (including unrealized gains (losses) during the year on unvested equity awards) in an effort to more closely reflect amounts actually earned by the NEOs.Named Executive Officers. The following table summarizes "reported compensation" values for our CEOChief Executive Officer and collective average for the other NEOs,Named Executive Officers, as compared to "actual compensation paid" values for the years ended December 31, 2020, 2021, 2022 and 20222023 (in thousands):

Reported Versus Actual Paid Compensation Values

| | | | | |

CEOChief Executive Officer Compensation | All Other Named Executive Officers Compensation |

| |

| |

As discussed above, "compensation actually paid" includes SECSecurities and Exchange Commission (the "SEC") required adjustments for unrealized gains and losses on unvested equity awards during the year. In the case of Ms. C. Taylor, the Company's CEO,our Chief Executive Officer, the adjustments for unrealized gains (losses) were $(4.4) million, $(0.1) million, $1.6 million and $1.6$(1.1) million in 2020, 2021, 2022 and 2022,2023, respectively. In contrast to the amounts presented above for “reported compensation” and “actual compensation paid,” compensation reported on Ms. C. Taylor's Form W-2's for these periods was $2.8 million, $3.2 million, $3.2 million and $3.2$4.9 million, respectively.

| | | | | | | | | | | |

| | | |

ITEM 3 | | | To conduct an advisory vote regarding frequency of future advisory votes on executive compensation.

As further discussed on page 32, this proposal provides stockholders the opportunity to indicate how frequently we should seek an advisory vote on our executive compensation, such as Item 2 above. By voting on this Item 3, stockholders can indicate whether they would prefer an advisory vote on executive compensation every one, two, or three years, or can abstain. |

|

|

| | | |

| | | |

| | The Board of Directors recommends that stockholders vote for the option of every “ONE YEAR” as the frequency with which stockholders are provided an advisory vote on the compensation of our named executive officers.

| |

| | |

| | | | | | | | | | | |

| | | |

ITEM

4

| | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2023.2024. As further detailed beginning on page 6567, our Board of Directors has ratified our Audit Committee’s appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2023,2024, and, as a matter of good governance, we are seeking stockholder ratification of that appointment. | |

|

|

| | | |

| | | |

| | The Board of Directors recommends that stockholders vote “FOR” the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2023.2024. | |

| | |

| | | | | |

| 10 | 20232024 Proxy Statement |

| | | | | | | | | | | |

| | | |

ITEM

5

| | To approve the Amended and Restated Certificate of Incorporation.

As further detailed beginning on page 67, this proposal provides for the limitation of liability of certain officers in limited circumstances as set forth under the Delaware General Corporation Law ("DGCL") and make other minor updates to remove certain provisions from our Certificate of Incorporation that are no longer relevant, as it has not been amended since 2001 (the “Amendment”). The Board has unanimously approved the Amendment, subject to stockholder approval. The Board has unanimously determined that the Amendment is advisable and in the best interests of the Company and our stockholders, and, in accordance with the DGCL, hereby recommends and seeks approval of the Amendment by our stockholders. | |

|

|

| | | |

| | | |

| | The Board of Directors recommends that stockholders vote “FOR” approval of the Amended and Restated Certificate of Incorporation.

| |

| | |

ITEM 1:

Election of Directors

The Board of Directors is currently comprised of eightseven members. The eightseven members are divided into three classes currently having threetwo members in each Class I and III,II, and twothree members in Class II.III. Each class is elected for a term of three years, so that the term of one class of directors expires at each Annual Meeting of Stockholders.

The term of the threetwo current Class III directors will expire at the Annual Meeting. The term of the Class IIIII directors will expire at the 20242025 Annual Meeting of Stockholders and the term of the Class IIII directors will expire at the 20252026 Annual Meeting of Stockholders.

Nominees

Based on the recommendation of our Nominating, Governance and Sustainability Committee, the Board of Directors has nominated Lawrence R. DickersonDenise Castillo-Rhodes and Cindy B. TaylorE. Joseph Wright to fill the expiring Class III positions on the Board of Directors, to hold office for three-year terms expiring at the Annual Meeting of Stockholders in 2026,2027, or until his or her successor has been duly elected and qualified, or until his or her earlier death, resignation or removal. Christopher T. Seaver, a current Class I director, is not standing for re-election and will retire when his term expires at the Annual Meeting. The director nominees, Lawrence R. DickersonDenise Castillo-Rhodes and Cindy B. Taylor,E. Joseph Wright, presently serve as Class III directors. Stockholder nominations will not be accepted for filling

Board of Directors seats at the Annual Meeting because

our bylaws require advance notice for such a nomination, the time for which has passed. Our Board of Directors has determined that Lawrence R. Dickerson isDenise Castillo-Rhodes and E. Joseph Wright are “independent” as that term is defined by the applicable New York Stock Exchange (the “NYSE”) listing standards. See “Director Independence” below for a discussion of director independence determinations. The Board of Directors recommends that stockholders vote “FOR” the election of Lawrence R. DickersonDenise Castillo-Rhodes and Cindy B. TaylorE. Joseph Wright as Class III directors.

There are no family relationships among executive officers and/or the directors of the Company.

Vote Required

A plurality of votes of the shares present in person or represented by proxy cast at the Annual Meeting and entitled to vote on the election of directors is required for the election of directors. A ballot for a nominee that is marked “withheld” will not be counted as a vote cast.

Both abstentions and broker non-votes will not have any effect

effect on the outcome of voting on director elections. If any

nominee should be unable to serve as a director, the shares represented by proxies will be voted for the election of a substitute nominated by the Board of Directors to replace such nominee, or the Board of Directors may reduce the size of the Board, at its discretion.

Director Resignation Policy

Our Corporate Governance Guidelines provide that in an uncontested election, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” such election (a “Majority Withheld Vote”) shall promptly tender his or her resignation for consideration by the Nominating, Governance and Sustainability Committee following certification of the stockholder vote.

The Nominating, Governance and Sustainability Committee shall promptly consider the resignation offer and make a recommendation to the Board of Directors as to whether the resignation should be accepted. In making this recommendation, the Nominating, Governance and Sustainability Committee will consider all factors deemed relevant by its members including, without limitation: (1) the underlying reasons why stockholders may have

“withheld” votes for election from such director, if known; (2) the length of service and qualifications of the director whose resignation has been tendered; (3) the director’s past and potential future contributions to the Company; (4) the current mix of skills and attributes of directors on the Board; (5) whether, by accepting the resignation, the Company will no longer be in compliance with any applicable law, rule, regulation, or governing instrument; and (6) whether accepting the resignation would be in the best interests of the Company and its stockholders. Thereafter, the Board will promptly disclose the material findings of its decision-making process and its decision as to whether to accept the director’s resignation offer (or, if applicable, the reason(s) for rejecting the resignation offer) in a Form 8-K furnished to the Securities and Exchange Commission (the "SEC").

| | | | | | | | |

| | The Board of Directors recommends that stockholders vote “FOR” the election of each of the director nominees. |

| |

| |

Item 1: Election of Directors

Nominees and Directors Continuing in Office

Set forth below are the names of, and certain information with respect to, the Company’s directors, including the nominees for election to the Class III positions of the Board of Directors as of March 28, 2023.26, 2024.

Nominees for Election at the Annual Meeting for a Term Expiring in 20262027 (Class III Directors)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| Age:

70

Director since:

May 2014

| | Lawrence R. Dickerson

Oil States Board Committees:

Compensation (Chair)

Other Current Public Directorships:

Great Lakes Dredge & Dock Corporation

Murphy Oil Corporation

|

| | | | | | | |

| | | | | | | |

| | Mr. Dickerson retired in March 2014 as President and Chief Executive Officer of Diamond Offshore Drilling, Inc., an offshore drilling company. During his 34-year career at Diamond, Mr. Dickerson held a number of senior positions, including Chief Operating Officer and Chief Financial Officer. He holds a B.B.A. from the University of Texas. |

| | |

| | Attributes, Skills and Experience |

| | | Executive Leadership | | Energy/Oilfield Services | | Past CEO |

| | | High Level of Financial Experience | | International Operations | | Past CFO |

| | | Outside Board Experience | | | | |

| | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| Age:

61

Director since:

May 2007

| | Cindy B. Taylor

Oil States Board Committees:

None

Other Current Public Directorships:

AT&T Inc.

|

| | | | | | | |

| | | | | | | |

| | Ms. Taylor is the Chief Executive Officer and President of Oil States and is a member of the Company’s Board of Directors. She has held these positions for 15 years since assuming the role in May 2007. From May 2006 until May 2007, Ms. Taylor served as President and Chief Operating Officer of Oil States and served as Senior Vice President—Chief Financial Officer and Treasurer prior to that. From August 1999 to May 2000, Ms. Taylor was the Chief Financial Officer of L.E. Simmons & Associates, Incorporated. Ms. Taylor served as the Vice President—Controller of Cliffs Drilling Company from July 1992 to August 1999 and held various management positions with Ernst & Young LLP, a public accounting firm, from January 1984 to July 1992. She received a B.B.A. in Accounting from Texas A&M University and is a Certified Public Accountant. |

| | |

| | Attributes, Skills and Experience |

| | | Executive Leadership | | Energy/Oilfield Services | | Present CEO |

| | | High Level of Financial Experience | | International Operations | | Past CFO |

| | | Outside Board Experience | | | | |

| | | |

Item 1: Election of Directors

Retiring at End of Term Expiring in 2023 (Class I Director)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| Age:

74

Director since:

May 2008

| | Christopher T. Seaver

Oil States Board Committees:

Audit

Other Current Public Directorships:

None

Former Public Directorships:

Exterran Corporation (2015-2022)

McCoy Global Inc. (2010-2022)

|

| | | | | | | |

| | | | | | | |

| | Mr. Seaver served as the President and Chief Executive Officer and a director of Hydril Company (“Hydril”), an oil and gas services company specializing in pressure control equipment and premium connections for tubing and casing, from February 1997 until Hydril was acquired in May 2007, at which point he retired. Mr. Seaver served as Chairman of Hydril from November 2006 to May 2007. From 1993 until 1997, Mr. Seaver served as President of Hydril. Mr. Seaver joined Hydril in 1985 and served as Executive Vice President of Hydril’s premium connection and pressure control businesses prior to February 1993. Prior to joining Hydril, Mr. Seaver was a corporate and securities attorney for Paul, Hastings, Janofsky & Walker, and was a Foreign Service Officer in the U.S. Department of State with postings in Kinshasa, Republic of Congo and Bogota, Colombia. Mr. Seaver has served as a director and officer of the Petroleum Equipment Supplies Association, a director of the American Petroleum Institute, and a director and Chairman of the National Ocean Industries Association. He holds a B.A. in Economics from Yale University, and M.B.A. and J.D. degrees from Stanford University. |

| | |

| | Attributes, Skills and Experience |

| | | Executive Leadership | | Energy/Oilfield Services | | Past CEO |

| | | High Level of Financial Experience | | International Operations | | Outside Board Experience |

| | | |

Item 1: Election of Directors

Directors Continuing in Office

Class II Directors (Term Expiring in 2024)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| Age: 6263

Director since: May 2021 Independent | | Denise Castillo-Rhodes Oil States Board Committees: Audit Other Current Public Directorships: None Former Public Directorships: Allegiance Bancshares, Inc. (2020-2022) |

| | | | | | | |

| | | | | | | |

| | Ms. Castillo-Rhodes is Chief Financial Officer of Texas Medical Center, where she oversees investments, accounting, finance, risk management and tax compliance. Ms. Castillo-Rhodes also serves as secretary of the board and chair of the Audit & Finance committee for Thermal Energy Corporation and as a director for the TMC Library and Texas Medical Center Hospital Laundry Co-Op,Co-Op, all of which are member institutions of Texas Medical Center. Ms. Castillo-Rhodes has served Texas Medical Center in this capacity since 2004. Prior to becoming Chief Financial Officer, from 2002-2004, Ms. Castillo-Rhodes served as Vice President and Controller for Texas Medical Center. Prior to joining Texas Medical Center, Ms. Castillo-Rhodes served as Controller for Nabisco’s Manufacturing Facility in Houston. Ms. Castillo-Rhodes is a Trustee for the City of Houston’s Municipal Employee Pension System and in 2022 was appointed by Governor Abbott to serve on the Governor's Commission for Women. Ms. Castillo-Rhodes holds a Bachelor of Business Administration from the University of Texas at El Paso and a Master of Business Administration from the University of St. Thomas. She is a Certified Public Accountant and is a member of the Texas Society of Certified Public Accountants and American Institute of Certified Public Accountants. |

| | |

| | Attributes, Skills and Experience |

| | | Executive Leadership | | Outside Board Experience | | |

| | | High Level of Financial Experience | | Present CFO | | |

| | | |

Item 1: Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| Age: 6364

Director since: June 2018 Independent | | E. Joseph Wright Oil States Board Committees: Compensation Nominating, Governance and Sustainability Other Current Public Directorships: CES Energy Solutions Corp. Former Public Directorships: Concho Resources Inc. (2017-2021) |

| | | | | | | |

| | | | | | | |

| | Since February of 2021, Mr. Wright has served as an independent partner of Geneses Capital Management, LLC. In January 2019, Mr. Wright retired from Concho Resources Inc. (“Concho”), an independent exploration and production company engaged in the acquisition, development and exploration of oil and natural gas properties, where he most recently served as Executive Vice President and Chief Operating Officer. He served as a director of Concho from May 2017 to January 2021. Since joining Concho from its formation in 2004, Mr. Wright held a variety of leadership positions, including Senior Vice President and Chief Operating Officer and Vice President of Engineering and Operations. As Executive Vice President and Chief Operating Officer, he oversaw Concho’s drilling and completion programs, as well as its government, regulatory affairs and human resources functions. Prior to Concho, Mr. Wright was Vice President of Operations and Engineering of Concho Oil & Gas Corp. from its formation in 2001 until its sale in 2004. From 1997 to 2001, he was Vice President of Operations of Concho Resources Inc., a predecessor company to Concho Oil & Gas Corp. Mr. Wright has also worked in several operations, engineering and capital markets positions at Mewbourne Oil Company. He holds a Bachelor of Science degree in Petroleum Engineering from Texas A&M University. |

| | |

| | Attributes, Skills and Experience |

| | | Executive Leadership | | Energy/Oilfield Services | | |

| | | Financial Experience | | Outside Board Experience | | |

| | | |

Item 1: Election of Directors

Directors Continuing in Office

Class III Directors (Term Expiring in 2025)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| Age: 6667

Director since: June 2018 Independent | | Darrell E. Hollek Oil States Board Committees: Audit

Nominating, Governance and Sustainability (Chair) Other Current Public Directorships: None |

| | | | | | | |

| | | | | | | |

| | Mr. Hollek served as Executive Vice President, Operations of Anadarko Petroleum Corporation (“Anadarko”), an independent oil and natural gas exploration and production company with operations onshore and offshore the United States, and internationally in Africa and South America until he retired in 2017. His responsibilities included U.S. onshore exploration, production and midstream activities along with Gulf of Mexico and international operations. During his 38-year career at Anadarko, Mr. Hollek held a number of senior leadership positions, including Executive Vice President, U.S. Onshore Exploration and Production, Senior Vice President, Deepwater Americas Operations and Vice President of Gulf of Mexico and Worldwide Deepwater Operations. Mr. Hollek holds a Bachelor of Science degree in Mechanical Engineering from Texas A&M University. |

| | |

| | Attributes, Skills and Experience |

| | | Executive Leadership | | Energy/Oilfield Services | | |

| | | Financial Experience | | International Operations | | |

| | | |

Item 1: Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | | | | |

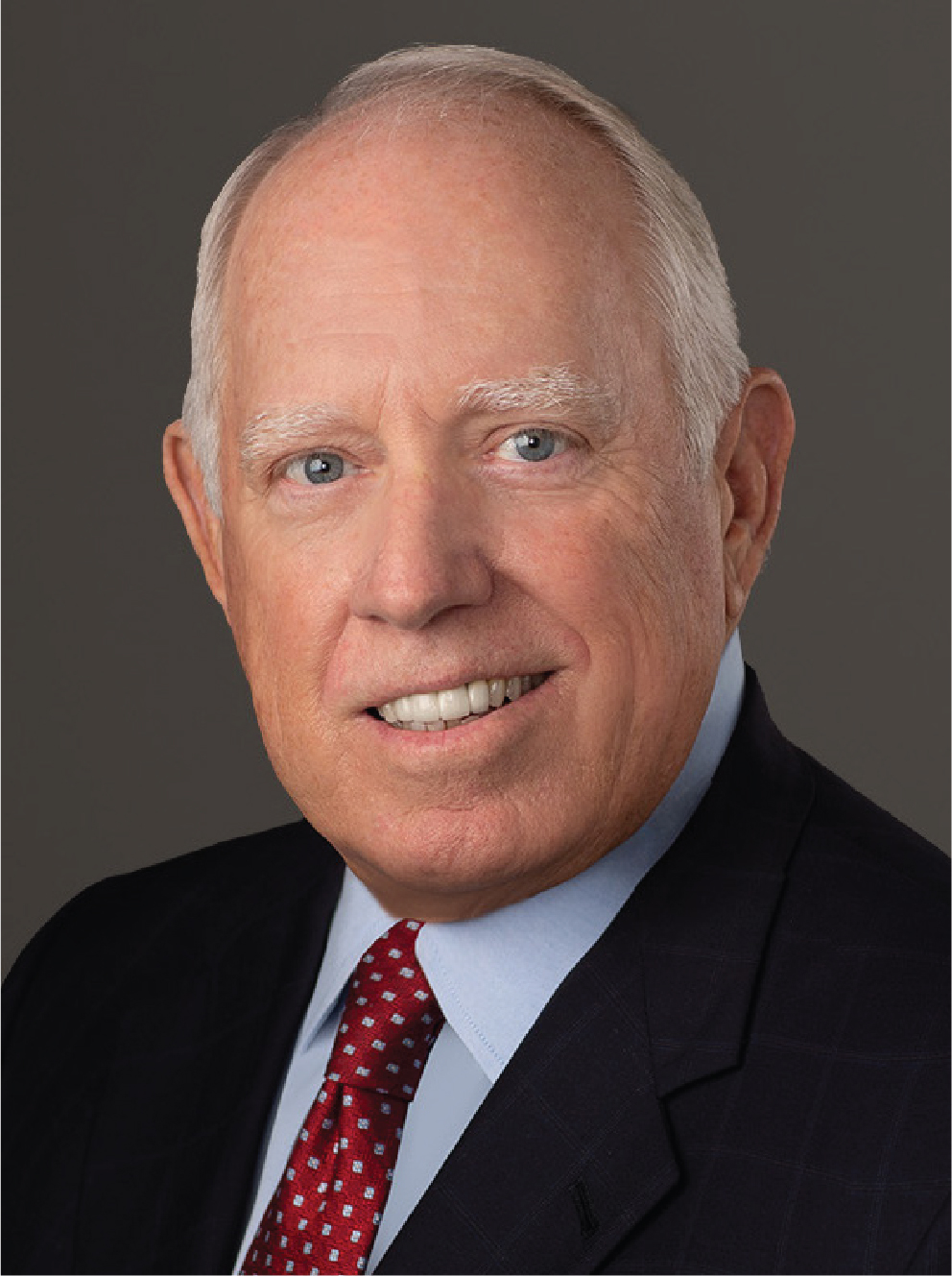

| | | |

| Age: 7273

Director since: July 2017 Independent ChairmanChair since: August 2018 | | Robert L. Potter Oil States Board Committees: Compensation

Nominating, Governance and Sustainability Other Current Public Directorships: None

|

| | | | | | | |

| | | | | | | |

| | Mr. Potter served as President of FMC Technologies, Inc. (“FMC”), a global provider of technology solutions for the energy industry, from August 2012 until November 2013 when he retired. Mr. Potter joined FMC in 1973 after his graduation from Rice University with a degree in Commerce. He served in a number of sales management roles in North America and overseas (Middle East, Europe, and Africa). Subsequently, he held numerous operations management roles responsible for multiple manufacturing facilities throughout North and South America. In 2001, Mr. Potter was appointed as Vice President of Energy Processing and a corporate officer following FMC Technologies split from FMC Corporation. In this role, Mr. Potter was responsible for multiple global businesses focused on downstream energy applications. In 2007, he was appointed Senior Vice President of Energy Processing and Global Surface Wellhead and then in 2010 to Executive Vice President of Energy Systems where he was responsible for FMC’s upstream and downstream portfolio. Mr. Potter is a former chairmanchair of the board for the Petroleum Equipment & Services Association and a former member of the board of directors of the National Ocean Industries Association. He is a current member of the Board of Advisors for the Jones Graduate School of Business at Rice University. |

| | |

| | Attributes, Skills and Experience |

| | | Executive Leadership | | Energy/Oilfield Services | | Outside Board

Experience |

| | | Financial Experience | | International Operations | | |

| | | |

Item 1: Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| Age: 6566

Director since: July 2019 Independent | | Hallie A. Vanderhider Oil States Board Committees: Audit (Chair) Other Current Public Directorships: EQT Corporation Former Public Directorships: Noble Midstream Partners LP (2016-2021) |

| | | | | | | |

| | | | | | | |

| | Ms. Vanderhider served as Managing Director of SFC Energy Partners, a private equity firm, from January 2016 to June 2022.2022, when she retired. Previously, Ms. Vanderhider served as Managing Partner of Catalyst Partners LLC, a merchant banking firm providing financial advisory and capital services to the energy and technology sectors, from August 2013 to May 2016. She served for ten years as President, Chief Operating Officer and member of the board of Black Stone Minerals Company, L.P., where prior to becoming President in 2007, she served as Executive Vice President and Chief Financial Officer. Prior to Black Stone, Ms. Vanderhider served as Chief Financial Officer for EnCap Investments from 1994 to 2003. Before joining EnCap, Ms. Vanderhider served as Chief Accounting Officer of Damson Oil Corp. She received a B.B.A. in Accounting from the University of Texas at Austin and is a Certified Public Accountant. |

| | |

| | Attributes, Skills and Experience |

| | | Executive Leadership | | Energy/Oilfield Services | | Past CFO |

| | | High Level of

Financial Experience | | Outside Board Experience | | |

| | | |

Item 1: Election of Directors

Class I Directors (Term Expiring in 2026)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| Age: 71 Director since: May 2014 Independent | | | | Lawrence R. Dickerson Oil States Board Committees: Compensation (Chair) Other Current Public Directorships: Great Lakes Dredge & Dock Corporation

Murphy Oil Corporation |

| 18 | | | | | | |

| | | | | | | |

| | Mr. Dickerson retired in March 2014 as President and Chief Executive Officer of Diamond Offshore Drilling, Inc., an offshore drilling company. During his 34-year career at Diamond, Mr. Dickerson held a number of senior positions, including Chief Operating Officer and Chief Financial Officer. He holds a B.B.A. from the University of Texas. |

| | |

| | Attributes, Skills and Experience |

| | | 2023 Proxy StatementExecutive Leadership | | Energy/Oilfield Services | | Past CEO |

| | | High Level of Financial Experience | | International Operations | | Past CFO |

| | | Outside Board Experience | | | | |

| | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| Age: 62 Director since: May 2007 | | Cindy B. Taylor Oil States Board Committees: None Other Current Public Directorships: AT&T Inc. |

| | | | | | | |

| | | | | | | |

| | Ms. Taylor is the Chief Executive Officer and President of Oil States and is a member of the Company’s Board of Directors. She has held these positions for 16 years since assuming the role in May 2007. From May 2006 until May 2007, Ms. Taylor served as President and Chief Operating Officer of Oil States and served as Senior Vice President—Chief Financial Officer and Treasurer prior to that. From August 1999 to May 2000, Ms. Taylor was the Chief Financial Officer of L.E. Simmons & Associates, Incorporated. Ms. Taylor served as the Vice President—Controller of Cliffs Drilling Company from July 1992 to August 1999 and held various management positions with Ernst & Young LLP, a public accounting firm, from January 1984 to July 1992. Ms. Taylor has been a director of the Federal Reserve Bank of Dallas since January 2020 and previously served as a director of the Federal Reserve Bank's Houston Branch from 2018 to 2019. She received a B.B.A. in Accounting from Texas A&M University and is a Certified Public Accountant. |

| | |

| | Attributes, Skills and Experience |

| | | Executive Leadership | | Energy/Oilfield Services | | Present CEO |

| | | High Level of Financial Experience | | International Operations | | Past CFO |

| | | Outside Board Experience | | | | |

| | | |

Item 1: Election of Directors

Executive Officers

The following profiles provide the relevant experience, age and tenure with the Company as of March 28, 202326, 2024 of our Chief Financial Officer and other executive officers of the Company. Information with respect to our Chief Executive Officer is included herein.

| | | | | | | | | | | |

| | | |

|

| | Lloyd A. Hajdik Executive Vice President, Chief Financial Officer & Treasurer Age: 5758 |

| | |

| | |

| | Mr. Hajdik joined the Company in December 2013. He has served as our Executive Vice President, Chief Financial Officer and Treasurer since May 2016 and as our Senior Vice President, Chief Financial Officer and Treasurer from December 2013 to May 2016. Prior to joining the Company, he served as the Chief Financial Officer of GR Energy Services, LLC, a privately-held oilfield services entity, from September to November 2013. From December 2003 to April 2013, Mr. Hajdik served in various financial management roles with Helix Energy Solutions Group, Inc. (“Helix”), most recently as Senior Vice President – Finance and Chief Accounting Officer. Prior to joining Helix, Mr. Hajdik served in a variety of accounting and finance related roles of increasing responsibility with Houston-based companies, including NL Industries, Inc., Compaq Computer Corporation (now Hewlett Packard), Halliburton Company, Cliffs Drilling Company and Shell Oil Company. Mr. Hajdik was with Ernst & Young LLP in the audit practice from 1989 to 1995. He graduated Cum Laude with a B.B.A. from Texas State University. Mr. Hajdik is an Advisory Board Member for the Energy Workforce & Technology Council, a Certified Public Accountant, a member of the Texas Society of CPAs, the American Institute of Certified Public Accountants and Financial Executives International. |

| | | |

| | | | | | | | | | | |

| | | |

|

| | Philip S. “Scott” Moses Executive Vice President and Chief Operating Officer Age: 5556 |

| | |

| | |

| | Mr. Moses joined the Company in August 1996. He has served as Executive Vice President and Chief Operating Officer since July 2022. From May 2021 to July 2022, he served as Executive Vice President, Offshore/ Manufactured Products and Downhole Technologies. From May 2016 to May 2021, he served as Executive Vice President, Offshore/ Manufactured Products. From July 2015 to May 2016 he served as President, Offshore/ Manufactured Products. From February 2013 to July 2015, Mr. Moses served as Senior Vice President, Offshore/ Manufactured Products having responsibility over all U.S. and international locations within that business segment. From February 2011 to February 2013, he served as Senior Vice President, Engineering and Industrial Products, Offshore Products. Since joining the Company immediately after attending college, Mr. Moses has held various engineering, project management and senior leadership roles engaged in product design, improving operational efficiencies, directing worldwide facility expansion efforts, and growing the Company through R&D initiatives as well as integrating several key acquisitions. Mr. Moses holds a B.S. in Mechanical Engineering from Texas A&M University. |

| | | |

Item 1: Election of Directors

| | | | | | | | | | | |

| | | |

|

| | Brian E. Taylor Senior Vice President, Controller and Chief Accounting Officer Age: 6061 |

| | |

| | |

| | Mr. Taylor joined the Company in September 2016. He has served as our Senior Vice President, Controller and Chief Accounting Officer since February 2022 and as our Vice President, Controller and Chief Accounting Officer from September 2016 to February 2022. Prior to joining the Company, Mr. Taylor managed personal family investments from January 2015 to September 2016. From April 2012 to December 2014, Mr. Taylor served as Vice President and Chief Financial Officer of Conn’s, Inc., a specialty retailer. Mr. Taylor served as Finance Integration Manager for Schlumberger Limited from September 2010 to April 2012, following its acquisition of Smith International, Inc. From September 1999 through August 2010, he served in various financial management roles with Smith International, Inc., including Corporate Vice President and Controller. Mr. Taylor also served two years at Camco International, Inc. (also acquired by Schlumberger Limited) as its Director of Corporate Accounting and Worldwide Controller. He began his career at Arthur Andersen L.L.P., spending 10 years in its assurance practice. Mr. Taylor is a Certified Public Accountant and received a B.S. in Accounting from Louisiana State University. |

| | | |

Corporate Governance

Corporate Governance Guidelines

The Company has adopted corporate governance guidelines entitled “Corporate Governance Guidelines,” which are available at www.oilstatesintl.com by first clicking “Corporate Governance” and then “Corporate Governance Guidelines.” These guidelines were adopted by the Board of Directors so that the Board of Directors has the necessary

authority and practices in place to make decisions that are independent from management, that the Board of Directors adequately performs its function as the overseer of management and to help ensure that the interests of the Board of Directors and management are aligned with the interests of the Company’s stockholders.

Selecting Our Directors

Our director nomination process for new Board of Directors members is as follows:

•The Nominating, Governance and Sustainability Committee, the ChairmanChair of the Board, or another member of the Board identifies a need to add a new Board member who meets specific criteria or to fill a vacancy on the Board of Directors.

•The Nominating, Governance and Sustainability Committee initiates a search by working with staff support, seeking input from members of the Board and senior management or hiring a search firm, if deemed necessary.necessary and endeavors to find an initial pool of qualified candidates that includes (but need not be limited to) persons that are diverse in viewpoints, backgrounds, education and business experience.

•The Nominating, Governance and Sustainability Committee considers candidate recommendations submitted by stockholders using the same criteria it applies to evaluate other candidates, consistent with the Board's practices and policies.

•The initial slate of candidates that will satisfy specific criteria and otherwise qualify for membership on the Board of Directors is identified and presented to the Nominating, Governance and Sustainability Committee.

•The ChairmanChair of the Board and at least one member of the Nominating, Governance and Sustainability Committee interview prospective candidate(s).

•The full Board of Directors is kept informed of progress.

•The Nominating, Governance and Sustainability Committee offers other directors the opportunity to interview the candidate(s) and then meets to consider and approve the final candidate(s).

•The Nominating, Governance and Sustainability Committee seeks the endorsement of the Board of Directors of the final candidate(s).

•The final candidate(s) are nominated by the Board of Directors or appointed to fill a vacancy (including a vacancy that results from the Board of Directors expanding the size of the Board).

To submit a candidate recommendation to the Nominating, Governance and Sustainability Committee, a stockholder should send a written request, as discussed below, to the attention of the Company’s Secretary at Oil States International, Inc., Three Allen Center, 333 Clay Street, Suite 4620, Houston, Texas 77002. A stockholder may make a nomination for election to our Board of Directors for the 20242025 Annual Meeting of Stockholders by delivering proper notice to our Secretary at least 120 days prior to the first anniversary date of the 20232024 Annual Meeting as more fully described below under Nominating, Governance and Sustainability Committee.

| | | | | |

| 20 | 20232024 Proxy Statement |

Qualifications of Directors

When identifying director nominees, the Nominating, Governance and Sustainability Committee will consider the following:

•the person’s reputation and integrity;

•the person’s qualifications to serve as an independent, disinterested, and non-employee or outside director;

•the person’s skills and business, government or other professional experience and acumen, bearing in mind the composition of the Board of Directors and the current state of the Company and the oilfield services industry generally at the time of determination;

•the diversity of the Board of Directors, and the optimal enhancement of the current mix of educational backgrounds;

•the number of other public companies for which the person serves as a director and the availability of the person’s time and commitment to the Company; and

•the person’s knowledge of areas and businesses in which the Company operates.

The Nominating, Governance and Sustainability Committee and the Board of Directors believe the above mentioned attributes, along with the leadership skills and other experience of its Board of Directors described below, provide the Company with the perspectives and judgment necessary to guide the Company’s strategies and monitor their execution.

The following table notes the breadth and variety of business experience that each of our directors bring to the Company.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | CASTILLO-RHODES | DICKERSON | HOLLEK | POTTER | SEAVER | C. TAYLOR | VANDERHIDER | WRIGHT |

| Knowledge, Skills and Experience |

| Executive Leadership | l | l | l | l | l | l | | l |

| Financial Experience | l | l | l | l | l | l | | l |

| Energy/Oilfield Services | | l | l | l | l | l | | | l |

| International Operations | | l | l | l | l | | | | |

| Past or Present CEO | | l | | | l | | | | | | |

| Past or Present CFO | l | l | | | l | l | | | | |

| Outside Board Experience | l | l | | l | l | l | | | l |

| Gender | | | | | | | |

| Man | | l | l | l | | | | | l |

| Woman | l | | | | l | l | | | | | |

| Race/Ethnicity | | | | | | | |

| African American or Black | | | | | | | | |

| Alaskan Native or American Indian | | | | | | | | |

| Asian | | | | | | | | |

| Hispanic or Latino | l | | | | | | | |

| Native Hawaiian or Pacific Islander | | | | | | | | |

| White | | l | l | l | l | l | | | l |

In selecting nominees for the Board of Directors, the Nominating, Governance and Sustainability Committee considers, among other things, educational background, business and industry experience, diversity and knowledge of different geographic markets and oilfield services and products. While the Board of Directors does not have a formal diversity policy in place to nominate diverse individuals for director, the Nominating, Governance and Sustainability Committee seesconsiders this as a priority and considers gender and ethnicity in the candidate selectionendeavors to select directors from an initial pool of qualified candidates that includes (but need not be

process.limited to) persons that are diverse in viewpoints, backgrounds, education and business experience. The Board of Directors currently includes three women and one individual who is Hispanic. In the case of current directors being considered for renomination, in addition to the Board skills and qualifications discussed above, the Nominating, Governance and Sustainability Committee takes into account the director’s service on the Board of Directors including the director's history of attendance at Board and committee meetings and the director’s preparation for and participation in such meetings.

Director Independence

To qualify as “independent” under the NYSE listing standards, a director must meet objective criteria set forth in the NYSE listing standards, and the Board of Directors must affirmatively determine that the director has no material relationship with us (either directly or as a partner, stockholder or officer of an organization that has a relationship with us) that would interfere with his or her exercise of independent judgment in carrying out his or her responsibilities as a director..

The Board of Directors reviews all direct or indirect business relationships between each director (including his or her immediate family) and our Company, as well as each director’s relationships with charitable organizations, to assess director independence as defined in the listing standards of the NYSE. The NYSE listing standards include a series of objective tests, such as the director is not an employee of our Company and has not engaged in various types of business dealings, directly or indirectly, with our Company.

In addition, as further required by the NYSE, the Board of Directors has made a subjective determination as to each independent director that no material relationships exist which, as determined by the Board of Directors, would interfere with the exercise of his or her independent judgment in carrying out the responsibilities of a director.between each such director and us. When assessing the materiality of a director’s relationship with us, the Board of Directors considers the issue not merely from the standpoint of the director, but also from the standpoint of the persons or organizations with which the director has an affiliation.

The Board of Directors has determined that Messrs. Potter, Dickerson, Hollek Seaver and Wright and Mses. Castillo-Rhodes and Vanderhider qualify as “independent” in accordance with NYSE listing standards. Prior to the retirement of Mr. Seaver from the Board of Directors in May 2023, he was determined to be independent. Ms. C. Taylor, our President and Chief Executive Officer, is the only non-independentnon-independent director.

Role and Responsibilities of the Board

Board of Directors Oversight of Enterprise Risk

Risk oversight is a responsibility of the Board of Directors. The Board of Directors utilizes an Enterprise Risk Management (“ERM”) process to assist in fulfilling its oversight responsibilities.

Management and all employees are responsible for day-to-day risk management, and eachmanagement. Each year, management conducts a comprehensive risk assessment of Oil States’ business. The risk assessment process is global in nature and is focused on four main areas: strategic risks (both internal and external); compliance risks; information technology risks; and operational risks. Information relevant to this risk assessment is obtained through surveys and/or interviews of key executives, business segment leaders, and other managers. ThisOur ERM process is designed to identify and assess the Company’s primarymost significant risks (over the short-, medium- and long-term) in these areas, includingincluding: the potential magnitude of the risk,risk; likelihood of the risk occurring,occurring; and the speed with which the risk could impact the Company,Company; as well as to identify steps to mitigate and manage each significant risk. The results of the risk assessment

assessment are reviewed on an annual basis with the Board of Directors and are integral to the Board of Directors and its committees’ deliberations.

The Board of Directors has delegated responsibility for overseeing certain enterprise risks to its standing committees. The Audit Committee oversees the monitoring and assessment of risks related to financial reporting, related compliance matters and cybersecurity. The Nominating, Governance and Sustainability Committee is responsible for overseeing risks related to compliance, business ethics, conflicts of interest, and environmental, social and governance ("ESG") matters, such as climate change. The Compensation Committee is responsible for overseeing the review and assessment of risks related to the Company’s compensation structurepolicies and programs to enhance the correlation of executive pay and performance objectives, and to maintain alignment of interests between executive management and the Company’s stockholders. The Nominating, Governance and Sustainability Committee is responsible for overseeing risks related to the Company's corporate governance policies, and environmental (including climate-related risks and opportunities), social and governance ("ESG") matters and sustainability activities and practices.

Executive & Director Stock Ownership and Retention Guidelines

We have executive and director stock ownership guidelines, designed to align executive and director interests with stockholder interests. For a description of the guidelines

applicable to our executive officers and directors, see “Compensation Discussion and Analysis – Executive Stock Ownership Guidelines.”

Anti-Hedging and Pledging Policies

Our directors and officers are prohibited from purchasing financial instruments designed to hedge or offset against a decrease in the market value of the Company’s stock, holding Company stock in margin accounts, or pledging Company securities as collateral for loans. These prohibitions apply to any Company equity held directly or

indirectly (including equity granted as compensation or otherwise held) by directors, and by executives and management personnel who are in charge of business segments, divisions or key functions (such as operations, sales, administration, finance or accounting), and any other

officer performing policy-making functions. Our anti-hedging policy does not address employees other than such officers, and does not directly address the designees of directors, officers or employees. While no categories of hedging are specifically permitted for directors and officers,

our policy does not specifically address prepaid variable forward contracts, equity swaps, collars or exchange funds, however entry into any of these would, in practice, be considered entry into a hedging transaction under our policy, and therefore would be prohibited.

Incentive Compensation Recoupment Policy for Named Executive Officers

Effective October 2, 2023, the Company’s Board of Directors adopted an incentive-based compensation recoupment policy (the “Recoupment Policy”) covering its Named Executive Officers responsive to SEC required changes in NYSE listing standards. The policy provides the Company with the ability to seek recoupment of any performance-based compensation received by a Named Executive

Officer on or after October 2, 2023 if the Company is required to restate its financial statements due to a material misstatement. For periods prior to October 2023, our Named Executive Officers were subject to the Company’s incentive compensation clawback policy described below.

Incentive Compensation Clawback Policy

The Company has adopted anits original incentive compensation clawback policy.policy in 2017. The policy provides the Company with the ability, in appropriate circumstances, to seek restitution of any performance-based compensation received by an

employee (including Named Executive Officers) as a result of such employee’s fraud or misconduct, resulting in a material misstatement contained in the Company’s financial statements, which results in a restatement of these financial statements.

The Board’s Role in Stockholder Engagement

Stockholders or other interested parties may send communications, directly and confidentially, to the Board of Directors, to any committee of the Board of Directors, to non-management directors or to any director in particular by sending an envelope marked “confidential” to such In October 2023, we adopted a new incentive compensation clawback policy

person or persons c/o Oil States International, Inc., Three Allen Center, 333 Clay Street, Suite 4620, Houston, Texas 77002. Any such correspondence will be forwardedto comply with new clawback laws (described above); therefore, our original policy was amended and restated to apply more generally to our employee population that may receive incentive compensation awards. However, with respect to any officer covered by the Secretarynew Recoupment Policy described above, to the extent that the Recoupment Policy and our original policy conflict or potentially cover the same event, we will apply the terms of the Company to the addressee without review by management.Recoupment Policy.

Corporate Code of Business Conduct and Ethics

All directors, officers and employees of the Company must act ethically at all times and in accordance with the policies comprising the Company’s ethics policy entitled “Corporate Code of Business Conduct and Ethics” (“Business Conduct and Ethics Code”). This policy is available on the Company’s web site at www.oilstatesintl.com by first clicking “Corporate Governance” and then “Corporate Code of Business Conduct and Ethics.”

Ethical principles set forth in this policy include, among other principles, matters such as:

•Acting ethically with honesty and integrity

•Avoiding conflicts of interest

•Complying with disclosure and reporting obligations with full, fair, accurate, timely and understandable disclosures

•Complying with applicable laws, rules and regulations

•Acting in good faith

•Promoting honest and ethical behavior by others

•Respecting confidentiality of information

•Responsibly using and maintaining assets and resources

Employees are required to complete online training on a regular basis which includes a review of the Business Conduct and Ethics Code and an acknowledgement that the employee has read and understands the policy. The Company has a Compliance Committee composed of key employees that meet quarterly to assess efforts and processes to ensure compliance with laws and regulations to which the Company is subject.

Financial Code of Ethics for Senior Officers

The Company’s Financial Code of Ethics for Senior Officers applies to the Chief Executive Officer, Chief Financial Officer, executive officers, principal accounting officer, and other senior accounting and financial officers (“Senior

(“Senior Officers”). Senior Officers must also comply with the Business Conduct and Ethics Code. Each of these policies are available for review on the Company’s website at www.oilstatesintl.com.

The Board’s Role in Stockholder Engagement

Stockholders or other interested parties may send communications, directly and confidentially, to the Board of Directors, to any committee of the Board of Directors, to non-management directors or to any director in particular by sending an envelope marked “confidential” to such

Corporate Governanceperson or persons c/o Oil States International, Inc., Three Allen Center, 333 Clay Street, Suite 4620, Houston, Texas 77002. Any such correspondence will be forwarded by the Secretary of the Company to the addressee without review by management.

Policies and Procedures with Respect to Related Person Transactions and Conflicts of Interest and Related Person and Party Disclosures

Related Person Transaction Policies and Procedures

Pursuant to our written policy, we review all relationships and transactions in which we and any Company director, executive officer or stockholder holding more than 5% of our common stock, or any immediate family member of any such person, is a participant to determine whether any such person has a direct or indirect material interest. Our Corporate Secretary’s office is primarily responsible for the development and implementation of processes and controls to obtain information from the directors and executive officers with respect to related person transactions and for then determining, based on the facts and circumstances, whether we or a related person has a direct or indirect material interest in the transaction.

We annually distribute a questionnaire to our executive officers and members of our Board of Directors requesting certain information regarding, among other things, their immediate family members, employment and beneficial ownership interests. This information is then reviewed for materiality and for potential related person transactions.

Additionally, the charter of our Nominating, Governance and Sustainability Committee requires that the members of such committee assess the independence of the non-management directors at least annually, including a requirement that it determine whether or not any such directors have a material relationship with us, either directly or indirectly, as defined therein and as further described above under “Director Independence.” Further, on an annual basis our Board of Directors assesses the independence of the non-management directors.

As required under the rules of the SEC, transactions in which we are a participant and in which a related person has a direct or indirect material interest, to the extent any exist, are disclosed in our Proxy Statement.

All material related person transactions must be reviewed, evaluated or ratified by the Audit Committee of our Board of Directors. Any member of the Audit Committee who is a related person with respect to a transaction is recused from the review of the transaction.

Conflict of Interest Policies and Procedures

Our Business Conduct and Ethics Code prohibits conflicts of interest.interest, except under guidelines approved by the Board of Directors. Under the Business Conduct and Ethics Code, conflicts of interest occur when private, commercial or familyfinancial interests interfere in any way, or even appear to interfere, with the interests of our Company. Our prohibition on conflicts of interest under the Business Conduct and Ethics Code includes transactions where a member of a director’s or an employee’s family or household, receives improper personal benefits as a result of the director’s or the employee’s position in the Company. Any waivers of these guidelines must be approved by the Nominating, Governance and Sustainability Committee.

Related Person and Party Disclosure